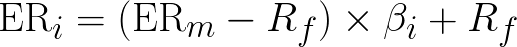

Formula

ERi

The expected return on the capital asset

Rf

The risk-free rate of interest such as interest arising from government bonds

betai

The sensitivity of the expected excess asset returns to the expected excess market returns

ERm

The expected return of the market